What is an Incremental Cost? Definition Meaning Example

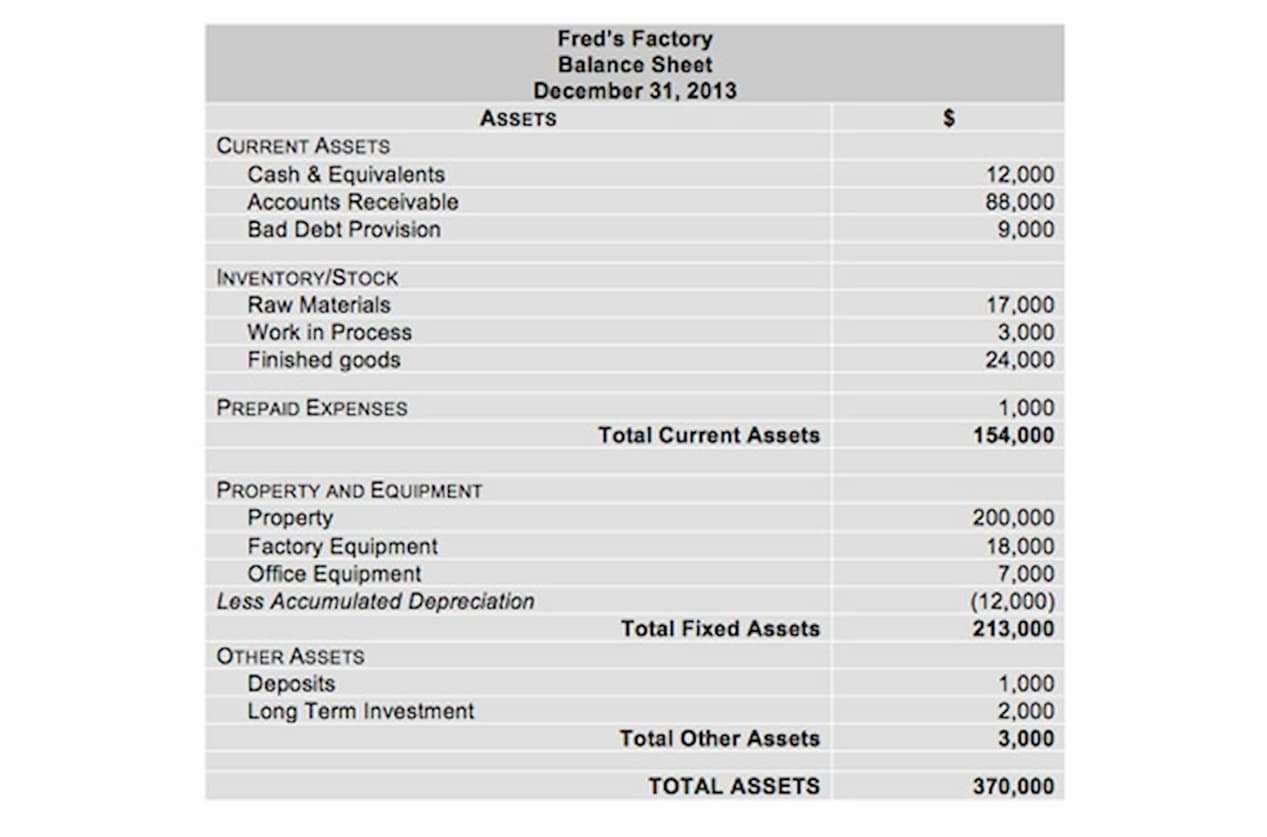

If a business is earning more incremental revenue (or marginal revenue) per product than the incremental cost of manufacturing or buying that product, the business earns a profit. The company has determined it will cost an additional $400 to manufacture one additional bike. Although the average unit cost is $500, the marginal cost for the 1,001th unit is $400.

- The Agency again notes that this is an initial screening criterion; it does not mean that a facility is subject by the rule.

- However, a facility owner or operator may combine their plans in a single ICP to reduce the administrative burden.

- They can include the price of crude oil, electricity, any essential raw material, etc.

- While this definition is not part of the Oil Pollution Prevention regulation in 40 CFR part 112, CWA hazardous substances differ from oil in important and varied ways and require different considerations.

- The guidance informs taxpayers that the Department of the Treasury and the Internal Revenue Service have reviewed the incremental cost for all street vehicles in calendar year 2023.

- EPA recognizes that some commenters believe that the timelines provided are too short or insufficient for FRP development and submission.

- Below are the current production levels as well as the added costs of the additional units.

EPA disagrees with commenters who asserted they were not adequately notified as per the APA. Indeed, the Agency extended the comment period to 120 days from 60 days to accommodate commenters who requested additional time (87 FR 29728, May 16, 2022). Additionally, EPA may require inspection of containment booms, skimmers, vessels, and other major equipment used to remove discharges (33 U.S.C. 1321(j)(6)(A)). EPA also has the authority to conduct unannounced drills of removal capability in areas for which ACPs are required and under relevant FRPs (33 U.S.C. 1321(j)(7)). This final rule is authorized by section 311(j)(5) and 501(a) of the CWA, (33 U.S.C. 1321(j)(5), 1361(a)).

C. What is the Agency’s authority for taking this action?

A variable cost is a corporate expense that varies in relation to the amount of product or service produced or sold. Variable costs rise or fall in relation to a company’s production or sales volume, rising as production increases and falling as production drops. If the LRIC rises, it is likely that a corporation will boost product pricing to meet the costs; the inverse is also true.

- (3) For substances in pipes, the maximum quantity of a pipe or interconnected pipes, and the owner or operator must provide evidence in Appendix A that containers with common piping or piping systems are not operated as one unit.

- If you make 500 hats per month, then each hat incurs $2 of fixed costs ($1,000 total fixed costs / 500 hats).

- If the owner or operator is developing a plan in January and does not want to amend their plan in the coming months, the maximum quantity onsite for chlorine may occur in March and the maximum quantity onsite of benzene may occur in September.

- Some commenters requested that EPA provide detailed, transparent, and clear guidance about the applicable drinking water standards to prevent inconsistencies in implementation and confusion for covered facilities.

- Companies look to analyze the incremental costs of production to maximize production levels and profitability.

The purpose of analyzing marginal cost is to determine at what point an organization can achieve economies of scale to optimize production and overall operations. If the marginal cost of producing one additional unit is lower than the per-unit price, the producer has the potential to gain a profit. EPA recognizes that, in some cases, it may be difficult to coordinate with LEPCs, TEPCs, or other local emergency planning and response organizations due to competing priorities or limited resources.

What is the meaning of variable cost?

They can include the price of crude oil, electricity, any essential raw material, etc. The calculation of incremental cost needs to be automated at every level of production to make decision-making more efficient. To increase production by one more unit, it may be required to incur capital expenditure, such as plant, machinery, and fixtures and fittings. A restaurant with a capacity of twenty-five people, as per local regulations, needs to incur construction costs to increase capacity for one additional person.

For mixtures, using capacity gets even more complicated, an issue raised by many commenters, since a covered facility owner or operator, or EPA inspector would have to convert varying volumes of CWA hazardous substances into weights, then extrapolate based on their proportions to the full capacity of the container. This seems needlessly complex and potentially introduces calculation errors into threshold applicability determinations and worst case discharge scenario quantities. To add to the complexity, CWA hazardous substance and mixtures can be present onsite in myriad types of containers and configurations. If the incremental cost of producing additional units is higher than the selling price, then it is not profitable to produce them. And if the marginal cost of producing an additional unit is lower than the selling price, producing more units may increase profitability. The fixed cost will be reduced in comparison to the cost of each unit made, enhancing your profit margin for that product.